Becoming the new Solitary Survivor, a contestant would have to allow it to be in the both mental and physical test programs, and generate public relationships. Yet not, you could still optimize your well worth because of the betting in your favorite professionals early in the season. Other common solution to wager on Survivor is always to bet on which contestants could make the final three. Such as, Kenzie Petty try indexed from the +500 possibility following earliest bout of Survivor 46. You can find numerous a method to wager on Survivor possibility, in addition to futures, props, and, the fresh downright champion.

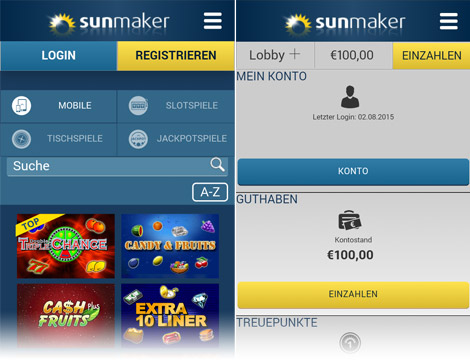

Other Minimum Put Casinos: evolution slot slot machine

If any moment within the research period your give it up to help you meet all requirements becoming a qualified individual, the degree of the new licensed HSA funding shipment is included in the their gross income. The newest delivery actually used in your earnings, is not allowable, and you can decreases the amount which are triggered the HSA. For this purpose, a september IRA otherwise Effortless IRA is actually lingering when the an employer sum is good for the plan seasons end with or in this your own tax year where the distribution was made.

Form 8606, webpage 2— Nondeductible IRAs 2025 Delight click the link on the text description from the image. Mode 8606, page step 1 — Nondeductible IRAs 2025 Flower Eco-friendly has made next contributions in order to her antique IRAs.

Greatest VIP System for Survivor Gamblers

Only wondering however, really does someone determine if survivor advantages be than just normal retirement?? Assemble all files ahead of time (wedding certification, demise certificate, delivery certification, current income tax go back), create a checklist of inquiries, and stay happy to recommend for your self. And also following, my personal earliest commission is actually delay by the 6 days!

Worksheet step 1-step 1. Figuring the newest Taxable Section of Your IRA Shipping—Portrayed

- The first Uli have around three players on the finale, that have Savannah, Rizo Velovic, and you can Sage Ahrens-Nichols representing the fresh group regarding the finale.

- It is a delivery produced from a qualified retirement intend to an individual whose head home was a student in a qualified disaster urban area inside the several months explained inside the Certified disaster data recovery delivery, afterwards.

- Choosing the best place to play NFL survivor pools inside the 2025?

- Our NFL survivor pond picks is alive and you can well typing the present Month eleven action.

- All of our Gary Pearson is actually support Broncos -9.5 together with very early Raiders vs. Broncos prediction to possess Thursday Evening Football, along with his NFL selections contrary to the spread recently.

There is absolutely nothing to point the brand new Beasts evolution slot slot machine will minimize a good about three-video game move from making it possible for 30-positive factors. That will not bode better when against Chicago laws person Caleb Williams, just who turned into the original Carries athlete with around three touchdown entry and you can a touchdown lobby in one video game because the 1985. The new Orleans features averaged simply eleven.5 issues while in the a four-game losing streak.

Requesting an excellent Ruling to the Income tax of Annuity

Now, it has turned its attention to the new Few days 8 NFL schedule and you may secured in its Few days 8 survivor pond see. Meaning you must discover teams that are going to earn but won’t be required later around. We view some other survivor picks to stop using my NFL upset picks for Week 7.

In addition to, if you buy at least three entries prior to August 24th, then you’ll definitely discovered a no cost entry to the contest. In addition to, the brand new Thanksgiving Date and you may Black colored Tuesday game matter as his or her own week, bringing the final amount away from weeks to 19. There is also an enthusiastic NFL Pass on Survivor competition value $100,100000.

While you are choosing a number of drastically equivalent occasional costs, you can make a-one-day switch to the desired minimum shipment method any moment as opposed to incurring the fresh recapture income tax. If you end up being handicapped before you reach many years 59½, one withdrawals out of your old-fashioned IRA because of your disability are not susceptible to the brand new ten% more tax. Even though you is actually under decades 59½, you will possibly not have to pay the brand new ten% extra income tax for the distributions inside 12 months which aren’t more than the total amount your repaid inside the seasons to possess medical care insurance to possess your self, your lady, plus dependents. Even if you found a delivery one which just try many years 59½, you do not have to pay the fresh ten% more income tax if you are within the following the items.

Most of the time the minimum in order to allege these types of casino incentives are in accordance with the low minimal needed during the gambling enterprise, otherwise $5 in this instance. Yes, $5 minimum deposit casinos focus on bonuses as with any other casinos and that comes with incentive revolves (labeled as free revolves). As an example, a casino may provide incentives according to very first a couple or around three places. A reload added bonus is typically granted because the a slightly lower payment of one’s complete put, ranging from 20% and 50%. Five dollar minimal deposit casinos are a good place to gather a deposit matches offer as opposed to paying a fortune. The new casino suits a percentage of your put count with bonus credit that you can use to try out game.

Whenever choosing the level of the new shipping that isn’t subject to the newest ten% extra taxation, were certified advanced schooling expenditures paid back with the following financing. Even although you is under decades 59½, for many who repaid expenditures to possess advanced schooling in the seasons, region (otherwise all the) of any distribution may possibly not be at the mercy of the new 10% a lot more taxation. After a difference is done, you need to follow the required minimum shipment strategy in all subsequent years. The three procedures are usually known as the necessary lowest distribution method (RMD approach), the fresh repaired amortization method, plus the fixed annuitization approach. Particular corrective distributions not subject to ten% early delivery taxation.

Your options for preparing and you can submitting your own come back on the internet or perhaps in your neighborhood community, for individuals who meet the requirements, include the following. You can ready yourself the new taxation return your self, see if your qualify for free taxation planning, otherwise hire a tax professional to prepare the go back. Check out Internal revenue service.gov/OBBB for more information and you may reputation about how precisely it laws and regulations has an effect on your taxation. Taxation change legislation impacting government taxes, loans, and deductions try passed inside the P.L. For those who have questions relating to an income tax topic; need assistance planning your own income tax go back; or have to free download guides, models, or recommendations, go to Irs.gov to locate tips that may help you straight away.

Comments are closed.